Top 5 Reasons Why You Should Hire a Professional to File Your Tax Grievance

Filing your tax grievance on your own is certainly possible and in order to do so, you’ll only have to assess the market value of your property, followed by filling out your Grievance petition and finally writing a letter in support explaining your position. However, in doing so

October 06, 2016

0 Comment

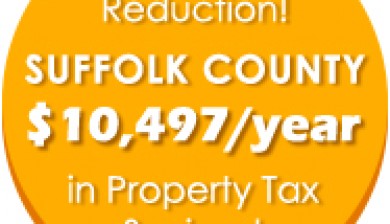

Long Island Tax Reduction Process Made Easy

Contrary to popular belief, the process of real estate tax reduction is not lengthy. In fact, with the right Tax Grievance firm, your grievance will be settled successfully and quickly. The Heller & Clausen Grievance Group is the Long Island Tax Grievance agency that you need to f

January 26, 2016

Commercial Real Estate: Will my property taxes go up as a result of my purchase price?

Commercial real estate transactions are on the increase and the volume is expected to reach a new high in 2016. Because of this, a lot of owners have started to research this trend and the way their buying price is going to influence their commercial property tax. We have a lot of pot

January 19, 2016

Nassau County Tax Grievance 2015

Property Tax Grievance Nassau County NY Homeowners in Nassau County have one chance a year to lower they’re exorbitant property taxes and this year the tax grievance filing deadline is March 2, 2015. According to a study by Zillow, Nassau County pay’s the nation’s fourth highest prope

January 20, 2015

Comments are off

5 Reasons to Hire a Firm to File Your LI Tax Grievance

You can undoubtedly file your Suffolk or Nassau County tax grievance by yourself. You only need to be able to research your property’s market value, fill out a Grievance petition, submit it to your assessor’s board, and most likely appear in a court appeal hearing. That said, we recom

December 04, 2014

Comments are off

5 Things Agents Need to Know About the Tax Grievance Process

There are a lot of misconceptions about the tax grievance process and how it works. Here is some information that will help you to understand the process, and help you to explain to your clients how the process can help you to sell their home faster and potentially for more money. 1.

July 17, 2014

Comments are off

Nassau County Tax Grievance 2016

Nassau County Property Tax Grievance 2016 Tax Grievance in Nassau County, NY has been getting a ton of press lately. Nassau County is one of only 5 counties in the state that are categorized as a “Special Assessment Unit” as defined by New York State. This affords Nassau County certai

Important Information Regarding 2014 STAR Exemption for Home-owners

To keep STAR tax break, you’ll need to reapply by Dec. 31 In coming weeks, homeowners will receive a letter instructing them to reapply for the STAR program online or by phone by Dec. 31. People will need to verify their salaries, Social Security numbers and primary residence. T

August 30, 2013

Comments are off

Think you are over-assessed? How to determine if you have a property Tax Grievance Case in Suffolk County

Suffolk County property tax grievance information: Below are answers to five questions that are commonly asked about filing a Suffolk County property tax grievance: 1. Q: What is a property tax assessment? A: Every year each individual town assessor’s office in Suffolk Count

April 23, 2013

Comments are off

Do I Need To Hire a Tax Grievance Company?

Tax grievance on Long Island has become a big business in the last few years as property values have continued to plummet. And while you do not need to hire a professional, most homeowner’s do because the process can be a daunting one. The town’s and counties know this, that is why m

April 16, 2013

Comments are off

Heller & Clausen Grievance Group Announces Today to Pay Homeowners if They Fail to Lower Tax in 2013

Like most tax grievance companies that offer no upfront costs, no fees and no reduction, Heller & Clausen Grievance Group offers a new promotion for this year to Homeowners to pay them $50 in the event they lose a case. Rocky Point, NY (PRWEB) April 02, 2013. Like most tax grieva

How To Know If You Are Eligible For a Tax Grievance In Suffolk County 2013?- Part 1

information issued by NYS. It will be a two-part blog posting… Suffolk County’s crippled real estate market should make almost every homeowner’s property value take a nosedive this year. The one silver lining – you might have a great opportunity at lowering your property taxes. If you

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. Read our Privacy Policy

The Heller & Clausen Long Island Tax Grievance Group, LLC.

333 Route 25A Suite 120

Rocky Point, NY 11778